Comments on findings

Labour market indicators 2022

“Labour market indicators” presents the main highlights among the vast range of employment data. The information is arranged to provide an overview of the Swiss labour market, along with the relevant statistics. Topics covered include employment, working hours, unemployment, job vacancies, dynamic aspects of the labour market, as well as salary structure and trends.

It consists of three sub-publications. This document comments on the results of the labour market indicators for the period 2016–2021 and the outlook for 2022. The additional document “Definitions” provides an overall view of the definitions used in the labour market statistics, while the “Statistical Sources” describes the methodological aspects of the various data sources.

Abbreviation in the graphs

ELS-ILO → Unemployment Statistics (ILO-based)

ES → Employment Statistics

ESS → Swiss Earnings Structure Survey

EUROSTAT → Statistical office of the European Union

GDP → Gross domestic product

JOBSTAT → Job Statistics

ILO → International Labour Organization

LMA → Labour Market Accounts

SECO → State Secretariat for Economic Affairs

SLFS → Swiss Labour Force Survey

SWI → Swiss Wage Index

WV → Work Volume Statistics

2016–2021: Major developments in the Swiss labour market

After a year marked by COVID-19 in 2020, the situation improved in 2021. From the 4th quarter 2020 to the 4th quarter 2021, the number of unemployed persons based on the ILO definition (International Labour Organization) and the number of people working short-time declined, while the number of job vacancies increased. In the five years from the 4th quarter 2016 to the 4th quarter 2021, the number of employed persons in Switzerland increased. Over the same period, the unemployment rate based on the ILO definition and the registered unemployment rate (persons registered at regional placement offices, RAV, as unemployed) fell slightly, despite a stronger fluctuation during the crisis.

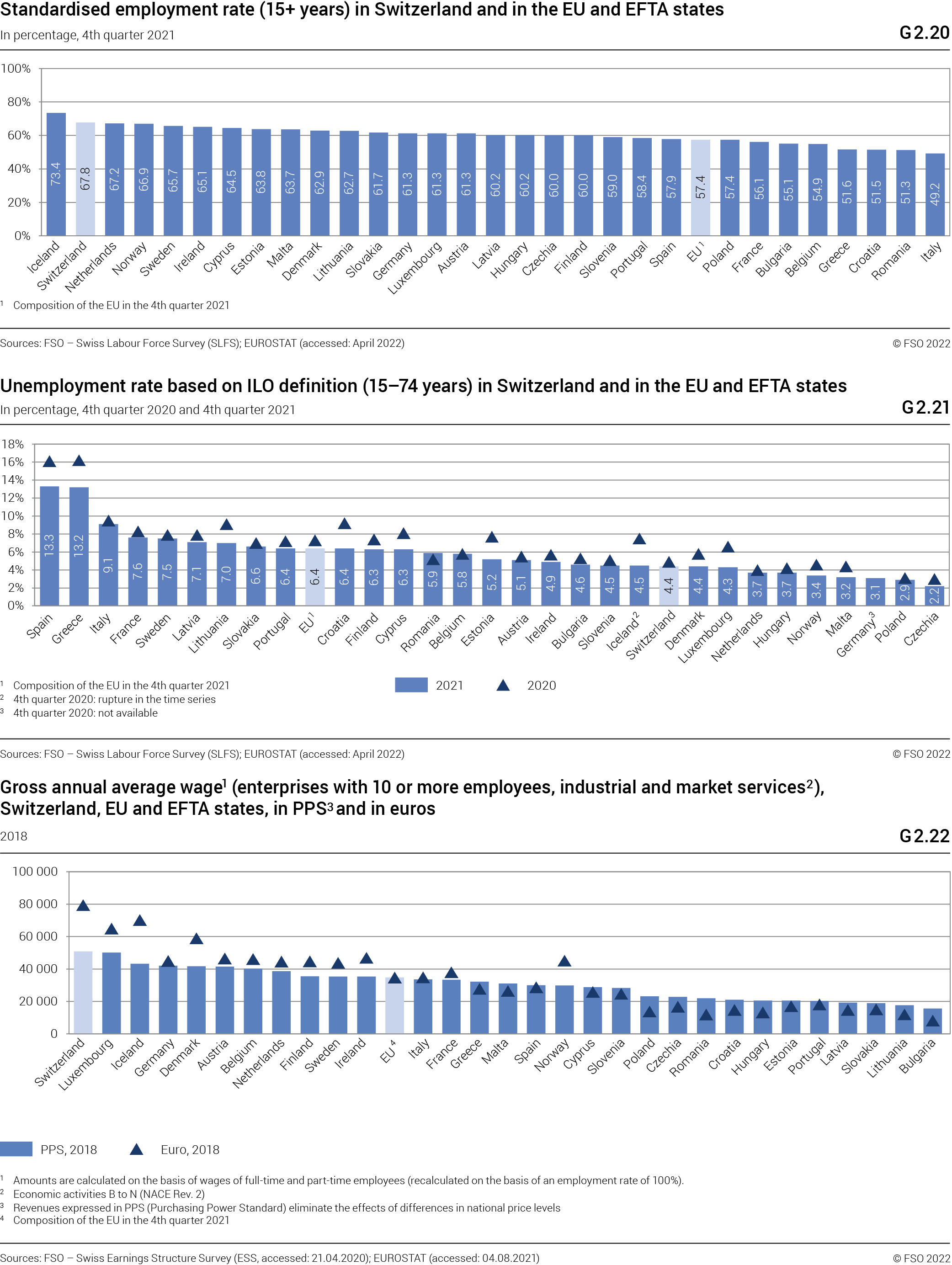

Economic recovery after a historic downturn

Prior to the COVID-19 pandemic, Swiss economic growth was relatively stable (+0.5% on average per quarter between the 4th quarter 2016 and the 4th quarter 2019). In 2020, the pandemic brought about a historic slump in economic growth with GDP falling by 6.1% in the 2nd quarter compared with the previous quarter. The economy recovered (+6.3%) during the 3rd quarter, but the upturn was short-lived as it subsequently declined slightly during the 4th quarter 2020 and in the 1st quarter 2021 (–0.1% in both cases). The Swiss economy recorded positive growth again from the 2nd quarter 2021 (+1.3% on average per quarter).

Employment: recovery after a year of pandemic

According to the Employment Statistics (ES), which are based on a survey of economically active persons (Swiss Labour Force Survey, SLFS), the number of employed persons rose by 3.3% between the 4th quarter 2016 and the 4th quarter 2021, rising from 5 million to 5.2 million. At the same time, the Job Statistics (JOBSTAT), which are based on a survey of secondary and tertiary sector enterprises, also showed a 6.0% increase in the number of jobs, rising from 4.9 million to 5.2. Most of this increase, however, came from the rise recorded up until the end of 2019. In fact, at the start of the pandemic, both the number of employed persons and the number of jobs declined. At the end of 2020, however, the labour market had recovered with figures remaining stable between the 4th quarter 2019 and the 4th quarter 2020 (–0.3% in both cases). Between the 4th quarters of 2020 and 2021, both the number of employed persons and the number of jobs rose (by 1.1% and 1.9% respectively).

Decline in unemployment

Over five years, the unemployment rate based on the ILO definition fell slightly, decreasing from 4.6% to 4.4%, and the registered unemployment rate (in a regional placement office, RAV) saw a marked delineate, decreasing from 3.5% to 2.6%). The relatively large difference between these two rates can be explained by the fact that the first rate also includes job seekers who are not registered with an RAV.

After peaking at over 1.3 million people working short-time in April 2020 (29% of the employed population), this number also declined. By the end of 2020, the number of people working reduced hours had fallen to 380 000, while by the end of 2021, the number had decreased to only 58 000.

Rise in the number of job vacancies

According to JOBSTAT, the number of job vacancies rose between the 4th quarter 2020 and the 4th quarter 2021 (+33 000, +50.2%). This was the largest annual growth seen over the whole period under review. In 2020, the number of vacancies had fallen sharply (–16 000 between the 4th quarter 2019 and the 4th quarter 2020), only to bounce back from the 1st quarter 2021. The number of vacancies available in the 4th quarter 2021 was 85.5% higher than that recorded five years earlier.

36.3% of companies (weighted according to the number of jobs) indicated that they had difficulty recruiting qualified personnel in the 4th quarter 2021 (+8.2 percentage points compared with the 4th quarter 2020). This was the largest annual increase over the past five years. However, this sharp rise needs to be put into context: the pandemic had a major impact on the Swiss labour market in 2020, with a decrease in labour demand. This trend has been reversed since the 1st quarter 2021. A comparison of the past five years also reveals that companies had never had such difficulty in finding suitable personnel as they did in the 4th quarter 2021 (+7.3 percentage points between the 4th quarter 2016 and the 4th quarter 2021).

Decline in nominal and real wages

In 2021, nominal wages fell by an average of 0.2% compared with the previous year. In real terms, with inflation at 0.6% in 2021, the purchasing power of wages in the economy as a whole fell by 0.8% after having risen in the previous years (+.05.% in 2019 and +1.5% in 2020). The purchasing power of wages fell for the fifteenth time since the Swiss wage index was created in 1942. Over the last five years, from 2017 to 2021, the average annual rate of real wage growth for all employees was 0.1%. Over this period, men's wages remained stable while women's wage rose by 0.3%. This sustained growth in the wage index for women is in keeping a long-term trend. Women's wages have become more similar to men's (23.7% median wage gap 1994 compared with 10.8% in 2020) but the gender wage gap persists.

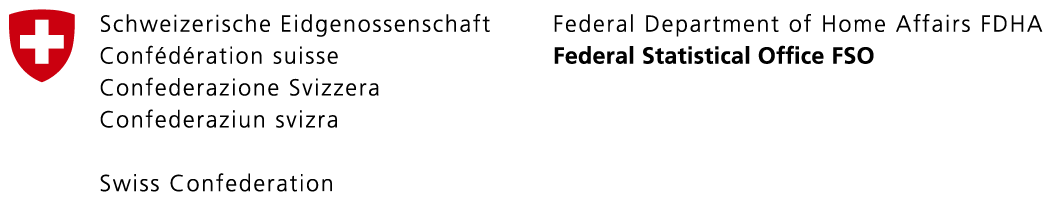

2016–2021: The situation of men and women in the labour market

Between 2016 and 2021, the share of women participating in the labour market increased. In 2021, women were still considerably more likely than men to be working part-time (58.1% compared with 18.1%). The unemployment rates based on ILO definition of men and women fell until the 1st quarter 2020, but then recorded a sharp rise until the third quarter 2021. Over a five-year period, the ILO unemployment rate for men did not change (4.4%) but for women it fell by 0.3 percentage points (to 4.5%). When comparing median wages in full-time equivalents, the gender wage gap was 10.8% in 2020, with only part of this difference explained by objective criteria.

Part-time work increasing among men

Part-time work is much more common among women than men. In the 4th quarter 2021, 58.1% of all employed women worked part time (in other words had a work-time percentage of less than 90%), i.e. 0.6 percentage points less than in the 4th quarter 2016. Among men, this rate has risen by 0.9 percentage points since the end of 2016 (to 18.1%). The unequal distribution of part-time work is also the reason why women accounted for only 38.9% of actual hours worked in 2021. In the 4th quarter 2021, 456 000 men worked part-time compared with 1.3 million women.

Women more likely than men to be employed in the services sector

Between the 4th quarter 2016 and the 4th quarter 2021, the trends of employed persons of both sexes were comparable in the tertiary sector, but slightly different in the secondary sector: while the number of women working in the secondary sector rose by 1.6%, the number of men stayed the same. The share of men and women working in the tertiary sector rose considerably (+5.1% and +5.7% respectively). Proportionally, women work considerably more frequently in the services sector than do men (88.2% of all employed women compared with 68.4% of all employed men). Only 10.3% of women are employed in industry and 1.5% in agriculture. The share of employed men working in industry is 28.8% and in agriculture 2.8%.

Share of women in economically active population rose slightly

The number of economically active persons (employed and ILO unemployed persons together, corresponding to the labour supply) rose between the 4th quarter 2016 and the 4th quarter 2021 by 1.2% among men (to 2.6 million) and by 3.3% among women (to 2.3 million). Thus, the share of women in the economically active population rose slightly (+0.5% percentage points to 47.1%). The number of employed women rose considerably more than that of men (+3.6% compared with 1.2%).

Unemployment rate of women fell

Between the 4th quarter 2016 and the 4th quarter 2021, the female unemployment rate based on the ILO definition fell (by 4.8% to 4.5%), but remained unchanged among men (4.4%). The two rates therefore became closer. In the 4th quarter of the pandemic year 2020, the unemployment rate of women was greater (5.4%) than that of men (4.5%). The initial impact of the pandemic was thus greater among women (+1.2 percentage points between the 4th quarter 2019 and the 4th quarter 2020) than men (+0.8 percentage points for the same period). The gap then narrowed in 2021, with a 0.1 percentage points difference between men and women at the end of the year.

Wage inequality between women and men is gradually decreasing

In 2020, the monthly median wage of women in the overall economy was CHF 6211 and that of men CHF 6963. The wage gap has narrowed since 2014, decreasing from 12.5% to 12.0% in 2016, to 11.5% in 2018 and to 10.8% in 2020. In the private sector, women earned 13.8% less than men in 2020, and 10.5% less in the public sector.

According to an analysis commissioned by the Federal Statistical Office, 54.6% of the wage gap (arithmetic mean) in 2018 in the whole economy could be explained by various objective factors such as place in the hierarchy, number of years' service or education. 45.4% of the pay gap remains unexplained.

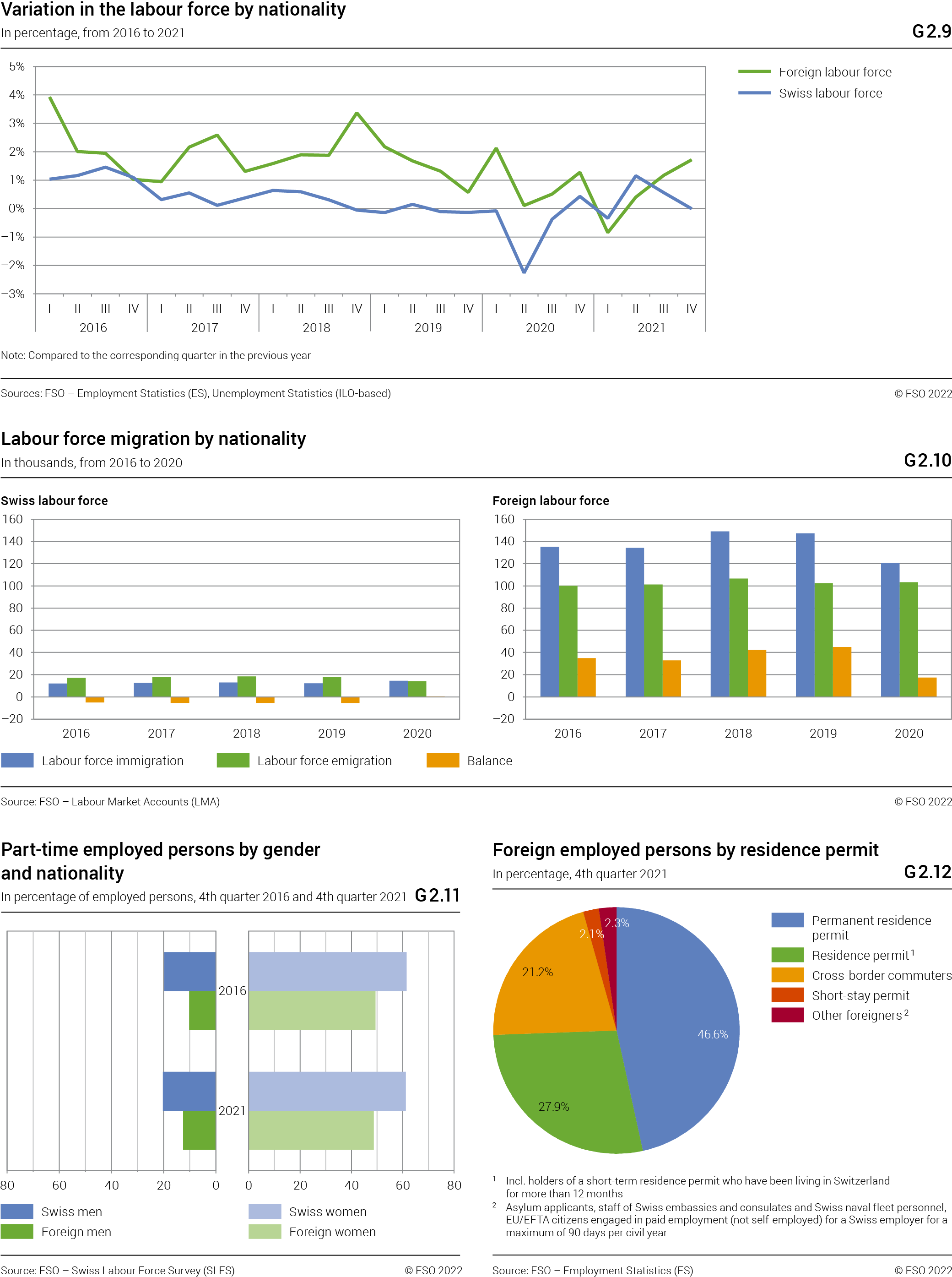

2016–2021: Swiss and foreign labour force

Since 2001, Switzerland has experienced a high influx of foreign workers. Between 2016 and 2021, the number of foreigners in the employed population rose sharply, while that of Swiss nationals only increased slightly. Without naturalisations, the difference would have been markedly greater. Over the entire period under review, the unemployment rate based on ILO definition was two to three times higher among foreign nationals than among Swiss nationals. Swiss workers generally earn more than their foreign counterparts, except in jobs with a high level of responsibility.

Level of foreign labour immigration remains high

Between the 4th quarter of 2016 and the 4th quarter 2021, the number of economically active persons with foreign nationality (employed and ILO unemployed) grew much faster than that of economically active Swiss nationals (+8.5% to 1.8 million compared with +0.6% to 3.6 million). The strong rise in the number of foreign workers is the result of heavy immigration: during the period 2016 to 2020 (cumulation of 5 years), immigration of foreign workers exceeded the number of emigrations by 173 000 persons. However, the annual net migration of economically active foreign nationals was halved between 2016 and 2020, falling from 35 000 to 17 000. In contrast, the migration of economically active Swiss citizens resulted in a negative balance of 21 000 over the five-year period. Naturalisations play a role in the structure of the economically active population: from 2016 to 2020, approximately 125 000 economically active foreigners obtained Swiss nationality. Were it not for these naturalisations, the number of foreign economically active persons would have increased by 16.1% between 2016 and 2020, whereas that of the Swiss economically active population would have fallen (–2.9%). In the 4th quarter 2020, the share of foreign nationals in the economically active population was 33.2% compared with 31.5% five years earlier.

Foreign nationals more often affected by unemployment

In the 4th quarter of 2021, 3.5 million Swiss nationals were employed in the labour market and 116 000 were unemployed based on the ILO definition. Thus, the unemployment rate based on the ILO definition of the Swiss population was 3.2%. For Swiss nationals, this rate fluctuated between 3.0% (4th quarter 2019) and 4.3% (4th quarter 2021) throughout the period under review. The situation of the foreign national economically active population was less favourable: in the 4th quarter 2021, 1.7 million foreign nationals were employed and 104 000 were unemployed. For foreign nationals, the unemployment rate based on the ILO definition was 7.6%. It had nevertheless decreased in comparison with the 4th quarter 2016 (8.3%).

Less part-time work among foreign nationals

Between the 4th quarter 2016 and the 4th quarter 2021, the number of people working part-time rose among both Swiss and foreign workers (+0.4 percentage points to 40.2% and +1.3 percentage points to 28.0%). This type of work is common among women, albeit more common among Swiss women than foreign women: in the 4th quarter 2021, 61.2% of Swiss women worked part-time, compared with 48.7% of foreign women. Among men, the corresponding shares were 20.3% and 12.6% respectively. Foreign workers are mainly salaried employees (94.6% compared with 89.8% of employed Swiss nationals). Only 5.4% are self-employed or work in a family-run enterprise, considerably less than Swiss employed persons (10.2%). This difference is attributable to several factors: in addition to the matter of integration comes the impossibility for the vast majority of first generation foreign nationals to take over a family-owned business. Moreover, the share of persons under age 40 is larger in the foreign population than in the Swiss population (the 40–64-year-old age group has a much higher proportion of self-employed persons than among those aged under 40).

Increase in the share of foreign cross-border commuters

The structure of the employed foreign population by permit status has changed only slightly in the past five years. While the shares of cross-border commuters holding a G permit rose slightly (by 1.0 points to 21.2%), that of permanent residence permit holders (C permit) fell slightly (by 0.1 points to 46.6%). The situation is similar for residence permit holder (B permit) with a decline of 0.5 points to 27.9% and of 1.0 points to 2.1% for short-term residence permit holders (L permit).

Foreign workers: differences depending on residence status

In 2020, in the economy as a whole, the median monthly wages of Swiss employees were higher than those of foreign workers (CHF 6988 compared with 6029). This wage gap in favour of Swiss workers compared with foreign workers was observed across all categories of residence.

However, when looking at jobs with a high level of responsibility, foreign workers had higher wages than their Swiss counterparts. Among senior managers, cross-border commuters earned CHF 10 692, those with resident permits CHF 12 268 and Swiss employees CHF 10 346.

The opposite held true for jobs without managerial responsibility. At CHF 6345, the wages of Swiss workers were higher than those of foreign workers: CHF 5773 for cross-border commuters and CHF 5287 for residence permit holders.

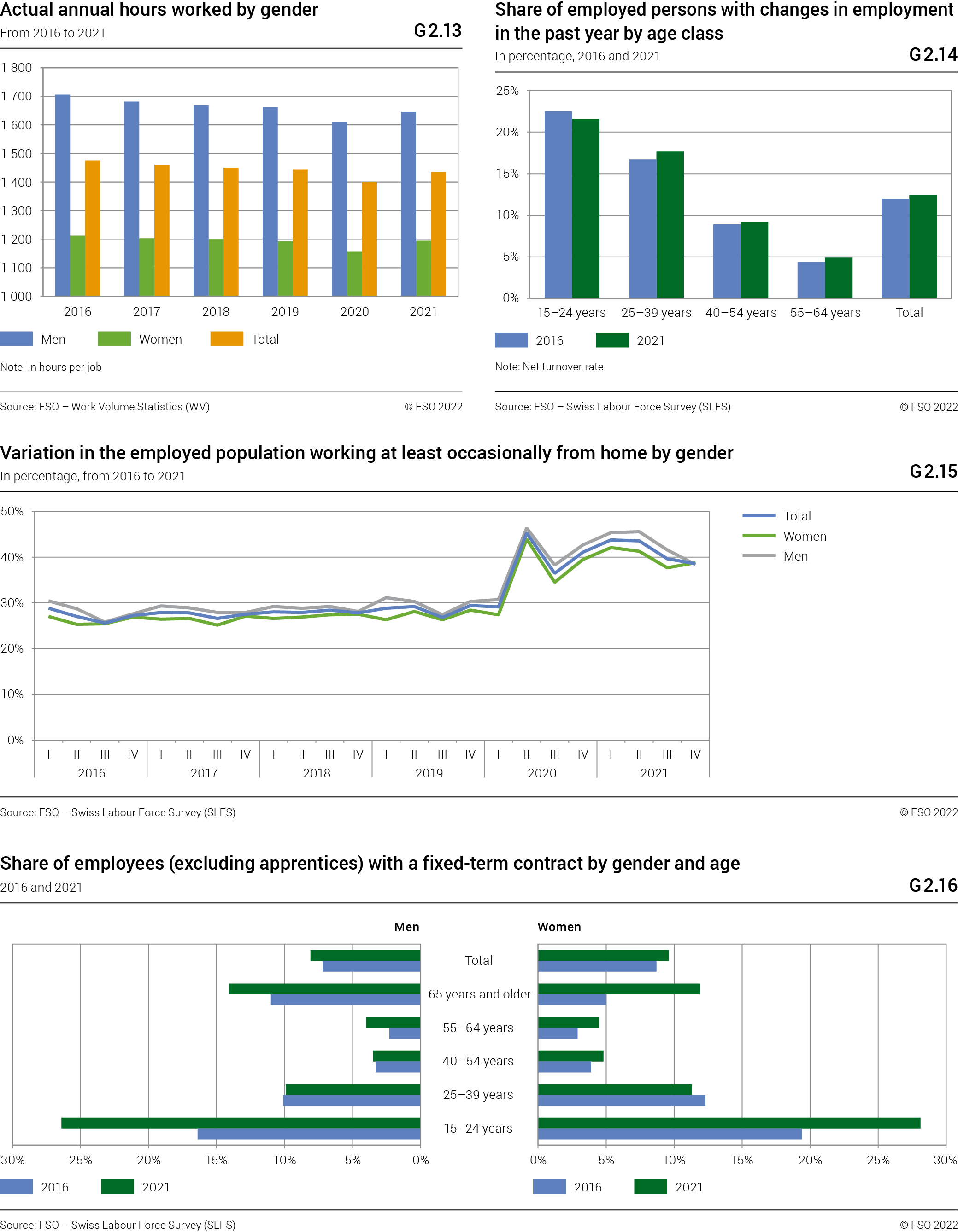

2016–2021: Working conditions in Switzerland

Working conditions in Switzerland changed between 2016 and 2021: there was a drop in the actual hours worked. The same period saw an increase in flexible working hours, in the number of fixed-term contracts and in working from home. The share of employed persons holding several jobs remained stable.

Actual annual hours worked decrease

Between 2016 and 2021, the actual annual hours worked per job continued to fall, settling at 1435 hours per job, i.e. a decline of 2.8% over five years. After a more marked decline between 2019 and 2020 due to the COVID-19 pandemic (–3.0%), the number of actual hours worked rose between 2020 and 2021 (+2.6%).

Over five years, the actual annual hours worked fell more sharply among men (–3.5%) than among women (–1.5%). The decline was greater among self-employed persons (–7.4%) than among employees (–2.7%).

Taking into account only full-time employees, actual weekly hours worked fell between 2016 and 2021 (–105 minutes to 39 hours and 16 minutes). It is notable that having recorded a sharp fall between 2019 and 2020, (–7.7%), the number of hours subsequently increased between 2020 and 2021 (+4.0%).

Flexible working hours on the rise

In 2021, 46.8% of employees had flexible working hours (compared with 44.7% in 2016).

Men were more likely to have flexible working hours than women (51.2% compared with 42.0%). However, since 2016 the percentage of women with flexible working hours has seen a greater increase (+3.3 percentage points) than among men (+0.9 percentage points).

Women more likely to share the same job with another person

In 2021, 9.6% of part-time employees were working in job sharing (sharing a job and its responsibilities between two people working part-time, usually with a single job description). Compared with 2016, this was a decrease of 0.2 percentage points. Job sharing is more common among women (10.3%) than men (7.1%). The number of people working in job sharing is pronounced in education, where 18.8% of all part-time employees share a job.

Young employees more often have a fixed-term contract

In 2021, 8.8% of employees worked on a fixed-term contract compared with 7.9% in 2016. The percentage of women (9.6%) was higher than that of men (8.1%). This type of contract is most common among employees aged 15 to 24 (27.4%, excluding apprenticeships).

Multiple employment remained stable

In 2021, 7.9% of employed persons had more than one job. In the past five years, the percentage of people in multiple employment remained stable.

Women are more often concerned than men. In 2021, the percentage of women (10.2%) holding more than one job was almost twice that of men (5.8%).

Young employed persons change jobs more often

Professional mobility rose slightly in Switzerland between 2016 and 2021. Overall, 12.4% of employed persons changed job in 2021 (compared with 12.0% in 2016); 3.4% of them within the same company and the remaining 9.1% to another company.

There is little difference in the percentage of women and men changing jobs (12.6% and 12.3% respectively). With increasing age, however, professional mobility declines considerably: while approximately a fifth of 15 to 24 year-olds (21.6%) and 25 to 39 year-olds (17.7%) changed job in 2021, only 4.9% of 55 to 64 year-olds did so.

Increase in working from home in 2021

The percentage of persons working from home rose sharply as a part of the measures to fight the COVID-19 pandemic A distinction should be made between "working from home" and "teleworking from home". The first term refers to any professional activity carried out at home, whereas the second is used specifically when the internet is used to exchange information with the employer or customers. In other words, "teleworking from home" is a form of "working from home". . While around a quarter (28.7%) of salaried employees worked from home occasionally in 2019, their share rose to 41.6% in 2021 (annual average). A peak of 45.3% was recorded during the 2nd quarter 2020, after which this percentage declined.

Rise in the number of salaried employees subject to collective labour agreements (CLA) and standard employment contracts (STC)

On the 1st of March 2018, 581 CLAs covering just over 2.1 million salaried employees were listed. 566 CLAs were CLAs with normative provisions (covering 1.9 million persons) and 15 CLAs had no normative provisions (covering 200 000 persons).

As of 1 March 2018, 103 STCs issued by the Federal Council or the cantons were in force in Switzerland. This corresponds to 77 ordinary STCs and 26 STCs providing for mandatory minimum wages in an economic sector or occupation in which there is repeated and abusive wage dumping.

Within the framework of the main Collective Labour Agreements (CLAs), i.e. those covering at least 1500 persons, the social partners agreed on a nominal increase in real wages of 0.4% on average for 2021 (2020: 0.9%; 2019: 1.1%; 2018: 0.9 and 2017: 0.5%). The CLAs ensure a wage increase that is often higher than that observed in the employed population as a whole.

For the year 2021, three cases of strike action were recorded, involving a total of 790 workers. This corresponded to 3190 working days not worked.

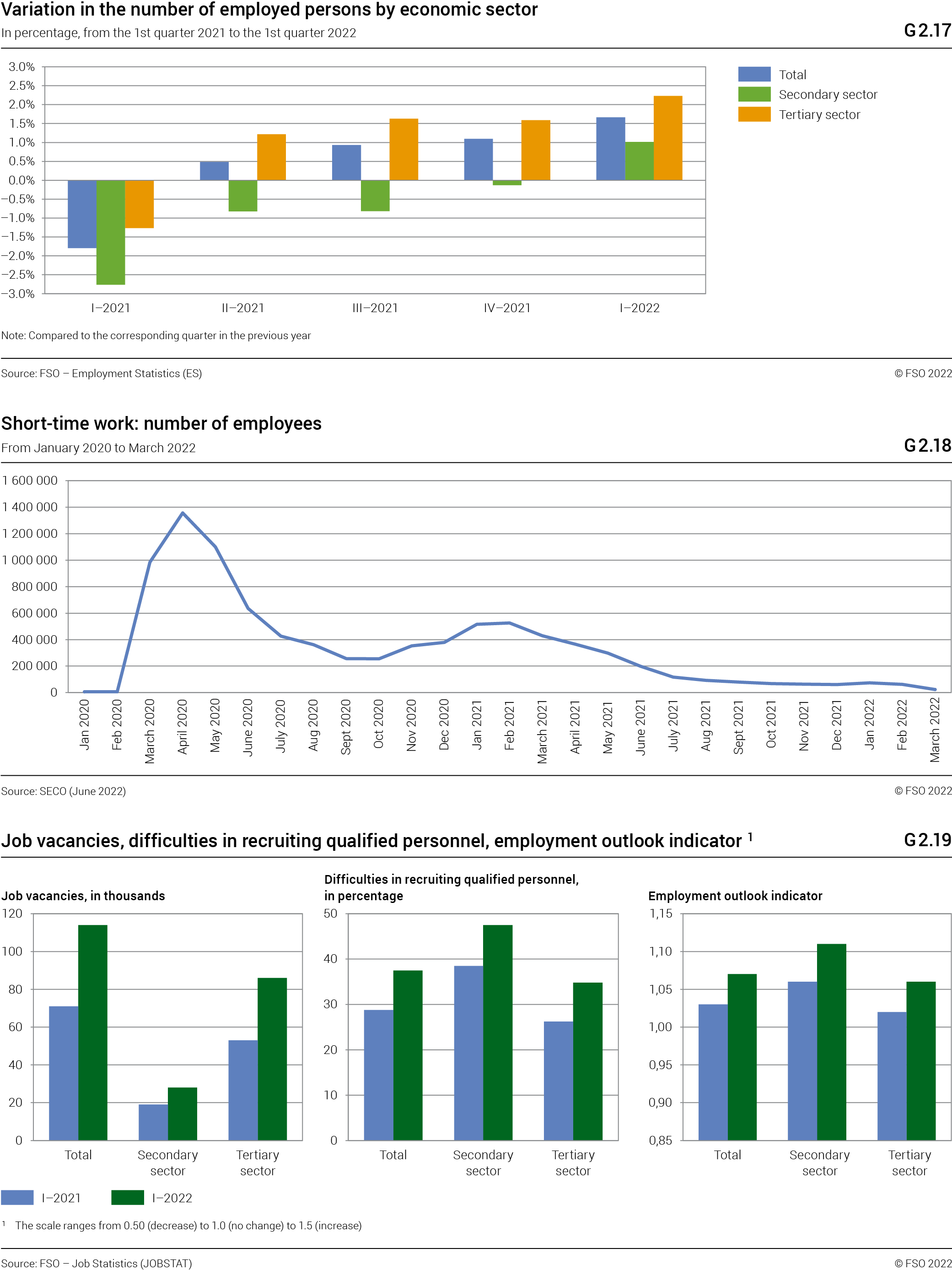

Labour market in 1st quarter 2022 and short-term prospects

The number of employed persons increased in the 1st quarter 2022 compared with the same quarter of the previous year. The unemployment rate as defined by both the ILO and SECO, as well as the number of people on short-time working fell. The development of these indicators reflects the improvement on the Swiss labour market affected by the COVID-19 crisis in 2020 and 2021. Furthermore, the employment outlook was optimistic at the end of the 1st quarter 2022. The Swiss economy counted 43 000 more vacancies than in the 1st quarter of 2021 (+60.4%) and the employment outlook indicator indicated an upward trend (+3.9% compared with 1st quarter 2021).

Rise in the number of employed persons and jobs

The number of employed persons rose by 84 000 or by 1.7% between the 1st quarters 2021 and 2022. This number increased both among men (+1.4%, to 2.8 million) and women (+2.0%, to 2.3 million). Furthermore, growth was weaker for employed Swiss nationals (+0.5%) than for employed foreign nationals (+4.1%). Among the latter, the number of employed persons grew mainly among short-term permit holders (L permit: +7.2%), among residence permit holders (C permit: +7.0%) and cross-border commuters (+5.6%).

Between the 1st quarters 2021 and 2022, the number of jobs in the secondary and tertiary sectors also rose (+2.5%) The different trends in the number of employed persons (Employment Statistics ES) and in the number of jobs (Job Statistics JOBSTAT) may be due, amongst other things, to differences in the basic statistical universe (households for the former and companies for the latter), in the statistical unit (persons for the former and jobs for the latter) and in the reference period (quarterly average for the former and end of quarter for the latter). When the economic situation deteriorates, the ES tends to give a more positive picture than JOBSTAT, and a more negative one when the situation improves. . The trend in job numbers varies depending on the economic sector, which were not all affected in the same way by the COVID-19 pandemic and the measures put in place to protect the public. The largest decreases were recorded in water transport and air transport (–4.3%) and in textile manufacturing (–3.6%). In contrast, jobs rose in the hotel and restaurant sector (+9.8%) and in scientific research (+7.8%).

Decrease in the number of unemployed persons

In the 1st quarter 2022, 228 000 persons were unemployed in Switzerland as defined by the International Labour Office (ILO). These unemployed persons based on ILO definition represented 4.6% of the economically active population, compared with 5.8% in 1st quarter 2021. The unemployment rate as defined by SECO was 2.4% at the end of March 2022, which was 1 percentage points lower than that at the end of March 2021. In absolute figures this rate represents some 110 000 persons registered as unemployed in the 1st quarter 2022 at a regional placement office and a decrease of almost 50 000 persons compared with 12 months previously.

The easing of measures relating to the COVID-19 pandemic led to a reduction in short-time work: In March 2022, 22 000 persons were working reduced hours whereas a year earlier this number was 430 000. Short-time compensation claims also declined significantly during the 1st quarter 2022.

Increase in job vacancies

In the 1st quarter 2022, 114 000 job vacancies were counted in the secondary and tertiary sectors, i.e. 43 000 more than in the same quarter of the previous year (+60.4%). The increase was significant in both the secondary sector (+50.0%) and the tertiary sector (+64.1%). The percentage of businesses experiencing difficulties in the recruitment of qualified personnel also grew considerably (+8.7 percentage points to 37.5%) compared with the 1st quarter 2021.

Jobs: optimistic outlook at the end of 1st quarter 2022

The employment outlook indicator, which represents businesses' expectations with regard to employment trends for the next three months, rose between the 1st quarters 2021 and 2022 (+3.9%). The improvement was observed in both the secondary (+4.9%) and tertiary sector (+3.7%). The weakest outlook improvement was seen for administrative and support service activities (+0.5%), public administration (+0.7%) and education (+0.8%). In contrast, the outlook improved most for the accommodation and food sector (+12.2%) and in the manufacture of machinery (12.1%).

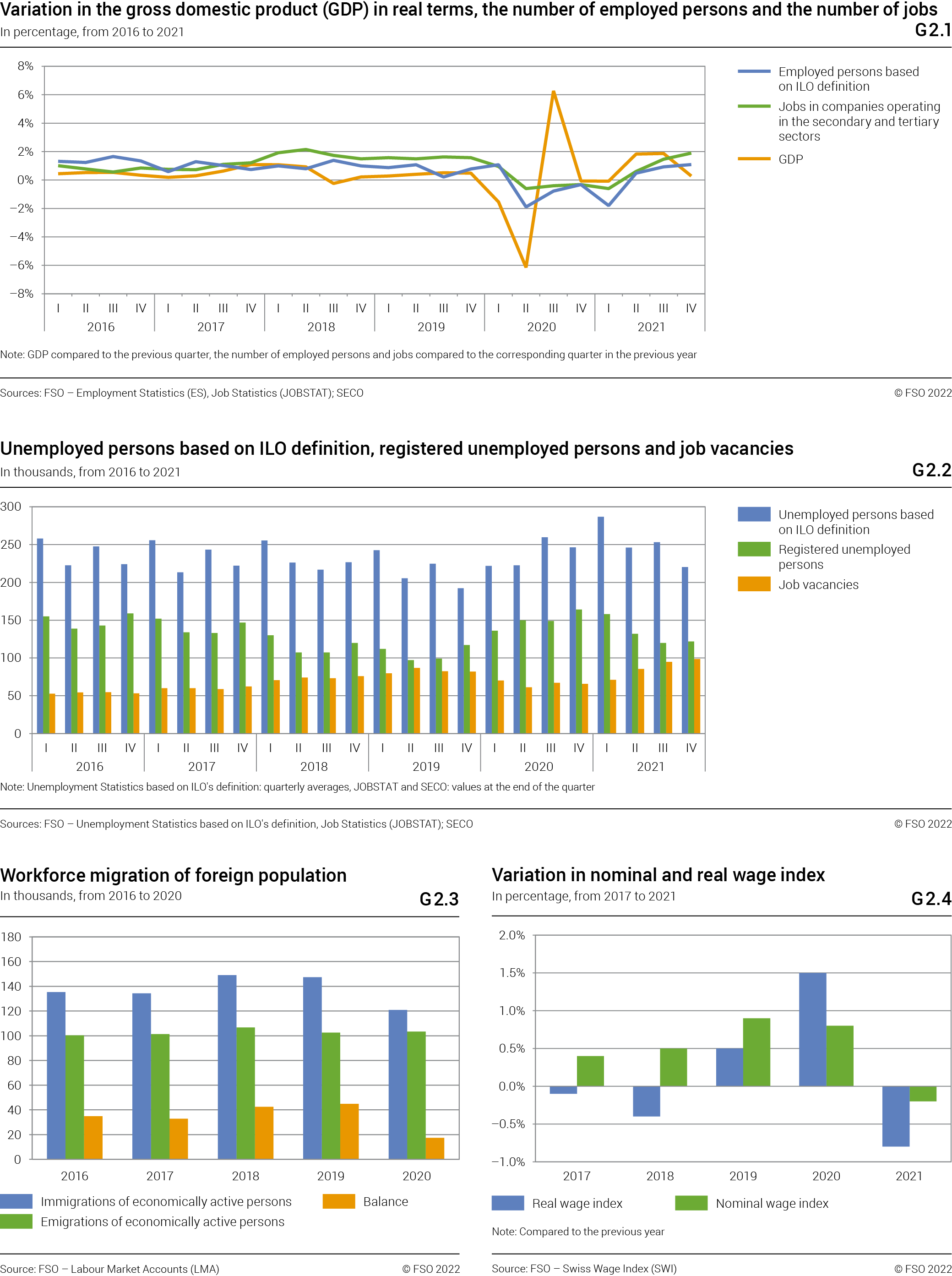

The Swiss labour market in international comparison

The Swiss labour market stands up well in international comparison. Both the economic activity rate and women's participation in the labour market are among the highest in Europe. Women's relatively high labour market participation can be explained by widespread part-time employment: the proportion of employed persons working part-time is markedly higher in Switzerland than in most European countries. Wages in Switzerland converted into Euros are higher than in EU countries. If the wages are converted into purchasing power standards to take into consideration the different price levels, the differences are less substantial.

High economic activity rate in Switzerland

In the 4th quarter 2021, the activity rate of the population aged 15 and over was 67.8% in Switzerland, one of highest rates in Europe. The rate of economically active persons was only higher in Iceland (73.4%), whereas Switzerland's neighbouring countries showed a much lower economic activity rate (Germany and Austria: 61.3%; France: 56.1%, Italy: 49.2%). Italy recorded the lowest economic activity rate in Europe, just behind Romania (51.3%), Croatia (51.5%) and Greece (51.6%). The EU average was 57.4%.

Strong participation by women in the labour force in Switzerland and in North European countries

Women's labour force participation rates differ greatly from one country to another. In Italy, two-fifths of women aged 15 and over (40.9%) were economically active in 2021, whereas in North European countries this rate was much higher (Iceland: 69.2%; Netherlands 63.0%; Norway 62.6%; Sweden 62.3%). In Europe as a whole, one in two women was economically active (51.7%). Compared with European countries, Switzerland ranked third with a rate of 62.9%. In the neighbouring countries, women's labour force participation is considerably lower (Germany and Austria: 56.3%; France: 52.3%). Women's labour force participation in Switzerland benefits from the wide availability of part-time jobs. In our country, 39.4% of employed persons worked part-time (women: 61.5%). Only in the Netherlands was this percentage higher (43.4%; Women: 65.0%). The percentage of employed persons working part-time was particularly low in Bulgaria (1.8%; Women: 2.3%) in Romania (3.4%; Women: 3.1% and in Slovakia (3.6%; Women: 4.8%).

In all of the countries examined, the male labour force participation rate was higher than that of women. The highest male economic activity rate was found in Iceland (77.4%) which was followed by Switzerland (72.8%). It was considerably lower in Switzerland's neighbouring countries (Austria 66.6%; Germany 66.4; France: 60.1%; Italy 58.1%). The EU average stood at 63.6%.

Low unemployment rate in Switzerland

In Switzerland, the unemployment rate based on the ILO definition increased by 0.5 points between the 4th quarter 2020 and the 4th quarter 2021 to 4.4%. The EU average on the other hand, decreased during the same period (–0.9 points to 6.4%), after having risen between 2019 and 2020 due to the COVID-19 crisis. Compared with the EU member states, Switzerland features among the countries with the lowest unemployment rates. In France (7.6%), Italy (9.1%) and Austria (5.1%) the unemployment rate is considerably higher. In Germany, however, it is lower (3.1%). The lowest rates are seen in Czechia (2.2%) and Poland (2.9%). In contrast, Greece and Spain are the European countries with the highest unemployment rate based on the ILO definition, with 13.2% (–3.0 points compared with 2020) and 13.3% (–2.8 points).

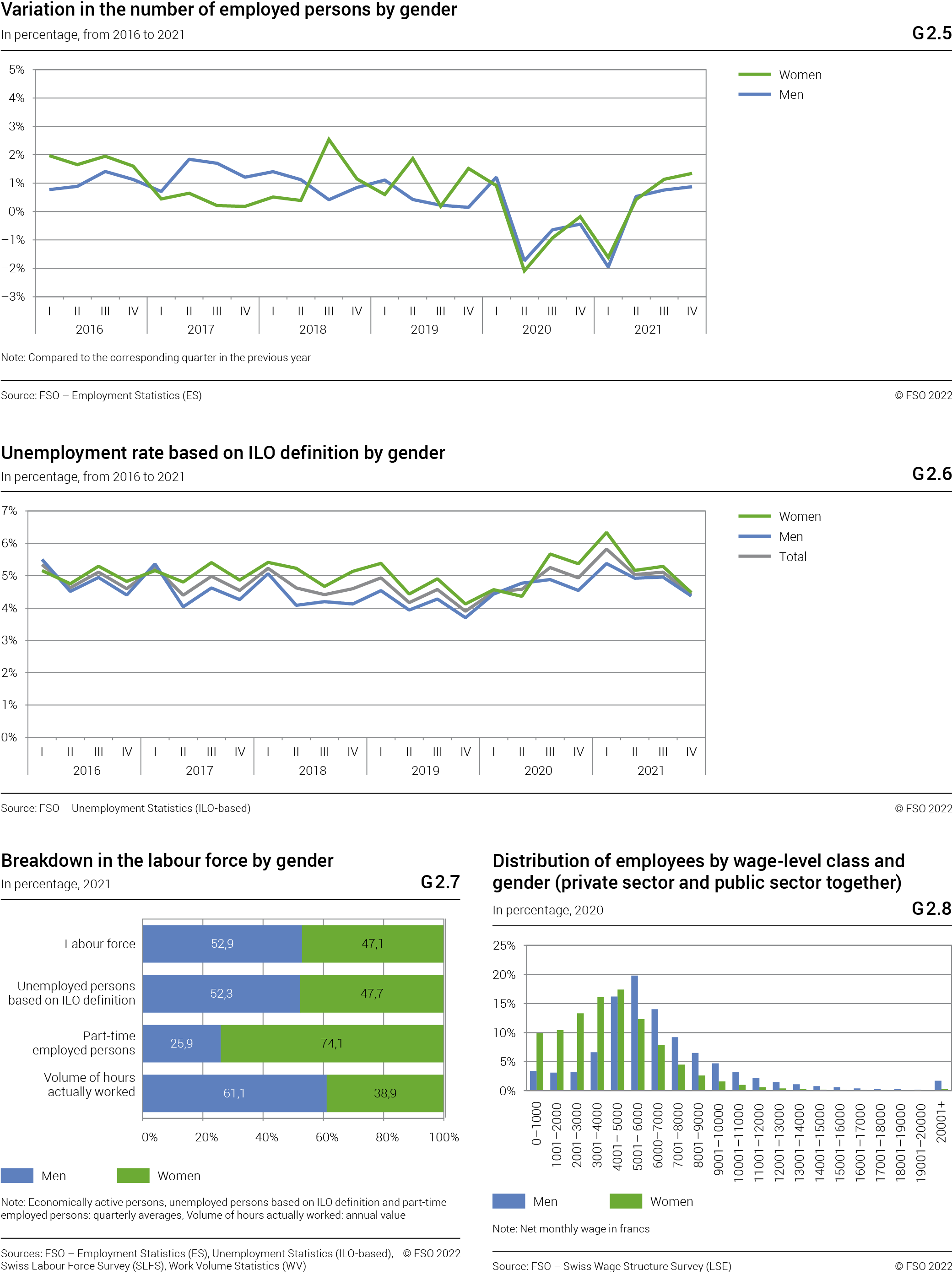

Wages in international comparison

The comparison of average gross annual wages for employees working in industry and market services highlights the wage gap between the different EU countries. Distinct differences can be noted not only between the EU15 countries and member states that have joined the EU since 2004, but also within these two groups of countries.

In the EU15 states, a north south divide can still be observed: in 2018, the highest gross annual wages were recorded in Luxembourg (EUR 64 932), the lowest in Portugal (EUR 18 111). The wage gap is even greater when the new member states are also included: in 2018 Lithuania (EUR 11 959), Romania (EUR 11 874) and Bulgaria (EUR 8147) come last in terms of gross annual wages in euros. With a gross annual wage of EUR 79 442, partly influenced by the strong Swiss franc, Switzerland occupied first place in front of Luxembourg.

In order to depict the actual purchasing power of wages, they must be converted from their national currency to a collective, fictional currency, the purchasing power standard (PPS). If the different price levels of each country are taken into account, the extent of the wage divide between countries is altered. Expressed in euros, the wages paid in Switzerland are almost nine times higher than those paid in Bulgaria (+875%), whereas the difference is almost four times smaller (+225%) when converted into PPS. Looking at Switzerland's neighbouring countries, expressed in euros, the annual wages paid in Switzerland are 71% higher than those paid in Austria, 77% higher than those paid in Germany, 109% higher than in France and 128% higher than in Italy. This difference is reduced when the comparison on average gross wages is made in PPS. The gaps are then only +23% compared with Austria, +21% compared with Germany, +52% compared with France and +51% compared with Italy.